The SBI Cashback Credit Card is one of the best cashback-providing credit card from SBI. It is an excellent choice for those who love online shopping. Let’s look at its features and benefits.

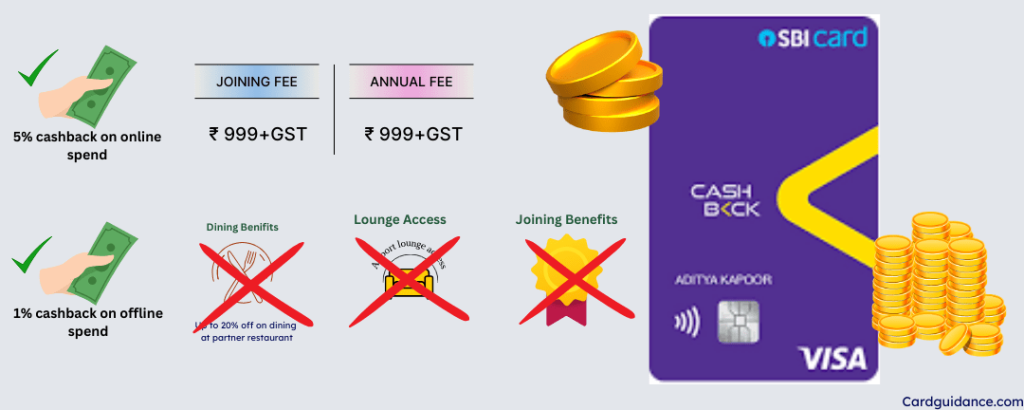

This credit card offers 5% cashback on all online purchases, whether it is fashion, electronics, food, travel, and entertainment. SBI Cashback credit card has a very simple and transparent cashback structure. You will also earn 1% cashback on offline spends. This is the reason why this card provides the best value. This card is one of the best credit cards in India that offers such high cashback with just a ₹999 joining fee.

Table of Contents

SBI Cashback Credit Card Review: A Comprehensive Overview

| Feature | Details |

|---|---|

| Issuer | SBI Bank |

| Network Type | Visa |

| Card Type | Cash Back |

| Joining Fee | ₹999+GST |

| Annual Fee | ₹999+GST(Waived on spending ₹ 2 lakh annual) |

| Joining Fees for add-on cardholder | Lifetime free |

| Joining Benefits | No joining Benefits |

| Best Suited For | Cashback |

| Reward Rate | 1% on offline spend 5% on online spend |

| Lounge Access | Complementary lounge access on cashback SBI credit card is discontinued effective midnight of 5th of May 2023 |

| Fuel Surcharge Waiver | 1% Fuel surcharge waiver across all fuel stations up to INR 100 per statement cycle |

Cashback benefits of SBI Cashback Credit Card

| Category | Cashback Earned | Notes |

|---|---|---|

| Online Spend | 5% Cashback | Applicable on all online purchases without merchant restrictions |

| Offline Spend | 1% Cashback | |

| Fuel Transaction | 1% surcharge waiver | Applicable on transactions between ₹500 and ₹3,000 across all petrol pumps in India; maximum waiver of ₹100 per statement cycle. |

Five Most Important Benefits of SBI Cashback Credit Card

- 5 % cashback on all online purchases, with a maximum combined cap of Rs. 5,000 per month for both online and offline spending.

- Flat 1% cashback on offline purchases.

- 1 % fuel surcharge waiver (max Rs. 100 per billing cycle) on fuel purchases across all fuel stations on fuel purchases between Rs. 500 to Rs. 3,000

- You will get 3 add-on cards at no extra cost.

- If you spend Rs. 200,000 or more in a year. The card’s annual fee will be waived for the next renewal cycle.

Lounge Access 💺

Unfortunately, SBI Cashback Credit Card Lounge Access was discontinued as of May 5, 2023

SBI Cashback Credit Card Charges & Fees 💵 ✨

The SBI Cashback Credit Card charges include an annual fee, foreign exchange markup, and late payment fees. Below is a breakdown of all applicable charges.

| Charge Type | Amount |

|---|---|

| Joining Fees | Rs. 999+GST |

| Annual Fees | Rs. 999 + GST (Waived on spending Rs. 2 lakh annually) |

| Finance charges on extended credit | 3.75% per month (45% per annum) |

| Foreign Exchange Markup fees | Rs. 999 + GST (Waived on spending Rs. 2 lakh annually) |

| Cash advance limit | Up to 80% of the credit limit (Max 15K per day) |

| Cash Advance fee | SBI ATMs or other domestic ATMs 2.5% of the transaction amount (Min Rs.500) International ATMs: -2.5 % of the transaction amount (Min Rs. 500) |

| Overlimit Fee | 2.5% of the over-limit amount or ₹500 (whichever is higher) applicable GST |

| Rs. 0 to Rs. 500 | Nill |

| Rs. 50 to Rs. 1,000 | Rs. 400 |

| Rs. 1,000 to Rs. 10,000 | Rs. 750 |

| Rs. 1,000 to Rs. 25,000 | Rs. 950 |

| Rs. 25,000 to Rs. 50,000 | Rs. 1,100 |

| Greater than Rs. 50,000 | Rs. 1,300 |

Eligibility

- Age: 21 to 70 years

- Salaried: should have regular income

- Self-employed– N/A

- Must be an Indian resident

Documents Requirement 📑

- Proof of Identity: Aadhaar, PAN, Passport

- Proof of Address: Utility bill, Aadhaar, Voter ID

- Proof of Income: Salary slip, ITR

Suggest reading: HDFC Bank Millennia Credit Card

Pros & Cons

Pros of SBI Cashback Credit Card

- 5% cashback on all online spending.

- The cashback is automatically credited to your statement. No tension of redeeming reward points.

- The annual fee will be waived with spending Rs. 200,000 or more in a year. Average Rs. 16,666 every month.

Cons of SBI Cashback Credit Card

- No welcome bonus after joining. Generally, most of the cards give you a welcome offer.

- Cashback earnings are capped per month. But still capped at Rs. 5,000 per month.

- This card does not provide any complimentary airport lounge access.

Final Words about SBI Cashback Credit Card

Yes, this card provides meaningful cashback on online and offline purchases. The SBI Cashback Credit Card is a great choice for online shopping, offering 5% cashback on all online purchases.

You are getting a good Rs. 5,000 monthly cashback cap.

Looking for unlimited cashback? Consider alternatives like the HDFC Millennia Credit Card or HDFC Swiggy Credit Card, which offer 5% cashback on all online spending (excluding some categories).

Click here to learn more terms and conditions

Apply For Cashback SBI Credit Card

Apply NowCashback SBI Credit Card PhoneBanking numbers 📞

- Cashback SBI number in India: 1860 180 1290:

- TheToll-free number for customer support.: 1800 180 1290:

- Email address: [email protected]

List of Credit Cards Similar to Cashback SBI Credit Card

- HDFC Millennia Credit Card

- Flipkart Axis Bank Credit Card

- Amazon Pay ICICI Credit Card

- Axis Bank ACE Credit Card

- HSBC Live+ Credit Card

Frequently Asked Questions (FAQs)

What is the annual fee, and how can I get it waived?

The SBI Cashback Credit Card has an annual fee of ₹999 + GST. However, the fee is waived if you spend ₹2,00,000 or more in the previous year.

What is the foreign currency transaction fee for this card?

A foreign exchange mark-up fee of 3.5% is applicable on transactions made in a foreign currency.

When does unredeemed Cashback expire on the Cashback SBI Credit Card?

Cashback earned on this card does not expire and is automatically credited to your statement in the next billing cycle.

Is there a limit on cashback on the SBI Cashback Credit Card?

Yes, the 5% cashback on online spending is capped at ₹5,000 per month. Any additional online spending beyond this limit will earn 1% cashback instead.

Does the SBI Cashback Credit Card offer Lounge Access?

Unfortunately, SBI Cashback Credit Card Lounge Access was discontinued as of May 5, 2023