If you are a credit card user, then you must be aware of the term POS sale. Many credit cards give reward points and cashback based on POS transactions.

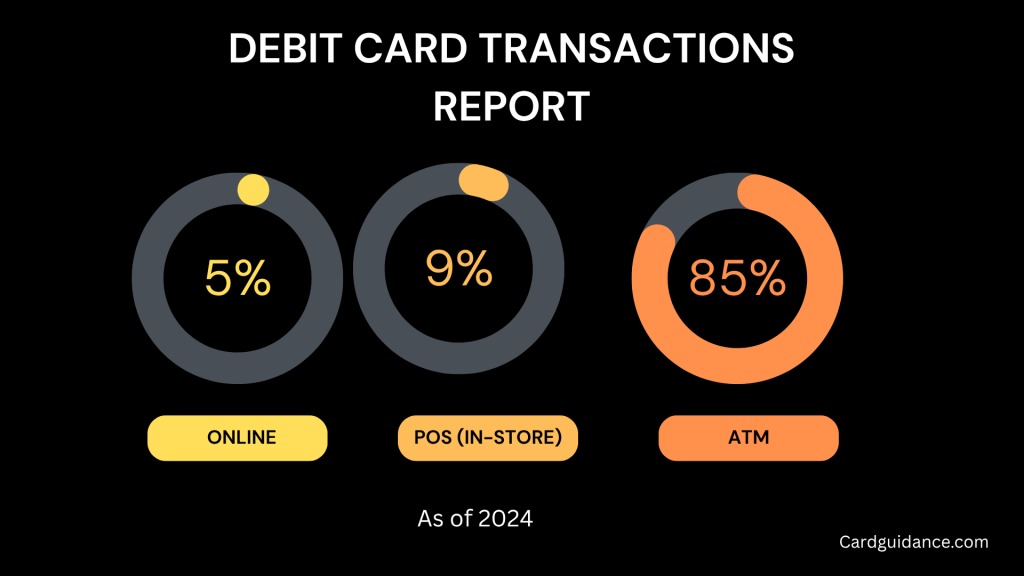

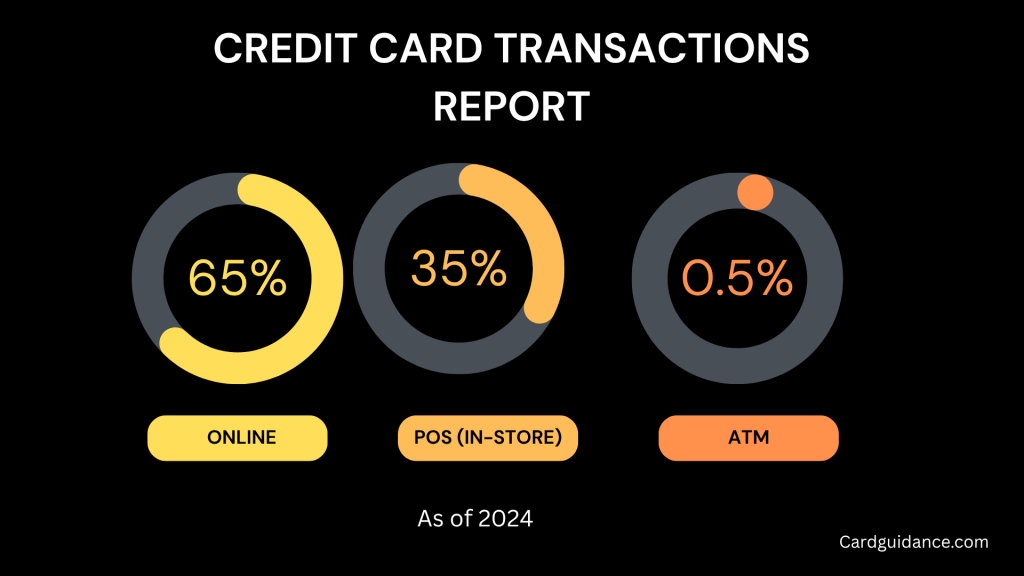

There are noticeable differences in POS vs online vs offline sales. Each type of transaction has its own benefits, risks, and rewards. To know more about this, read the article below.

Quick Comparison of POS vs Online vs Offline Sales

| Feature | POS Sale | Online Sale | Offline Sale |

|---|---|---|---|

| Sales Channel | In-store (via POS system) | Website or mobile app | Physical store (manual or simple billing) |

| Internet Required | Not necessarily | Yes | Yes |

| Payment Modes | Card, UPI, cash, mobile wallets | Credit card, UPI, net banking, wallets | Cash, card, UPI |

| Customer Interaction | Face-to-face | Virtual (chat, email, call) | Face-to-face |

| Examples | Supermarkets, clothing stores with POS | Amazon, Flipkart, Myntra | Local kirana shop |

Offline Sales (Cash + Card at Stores)

Offline sales mean when you swipe your credit or debit card on a machine at a retail shop or supermarket.

- No internet is required for the user; it is required only for the store’s card machine.

- PIN may be required for safety and security, or if tap payment is on, then PIN may not be required

- Credit card and debit card offers like instant cashback and discounts often apply here.

- You need to be careful because card skimming can happen if you are not alert

Online Sales (E-commerce, App Orders)

For online sales, you only have to enter card details on the online platform, and then any transaction can be done.

- OTP is a must for verification before you complete the transaction.

- Great for credit card reward points, EMI offers, and exclusive deals.

- Enter your credit and debit card details only on a trusted platform.

POS Sales (Point of Sale Terminals)

POS means Point of Sale. POS machines are used in both online and offline modes (e.g., delivery agents, restaurants)

- POS machines support NFC contactless tap-to-pay.

- Very fast and increasingly common in Tier 2 and Tier 3 cities.