The HSBC Visa Platinum Credit Card is an entry-level credit card. If you are a salaried individual with a minimum annual income of INR 400,000, you are eligible to apply for this card. It is a rewards-based credit card that allows you to earn air miles from leading airlines.

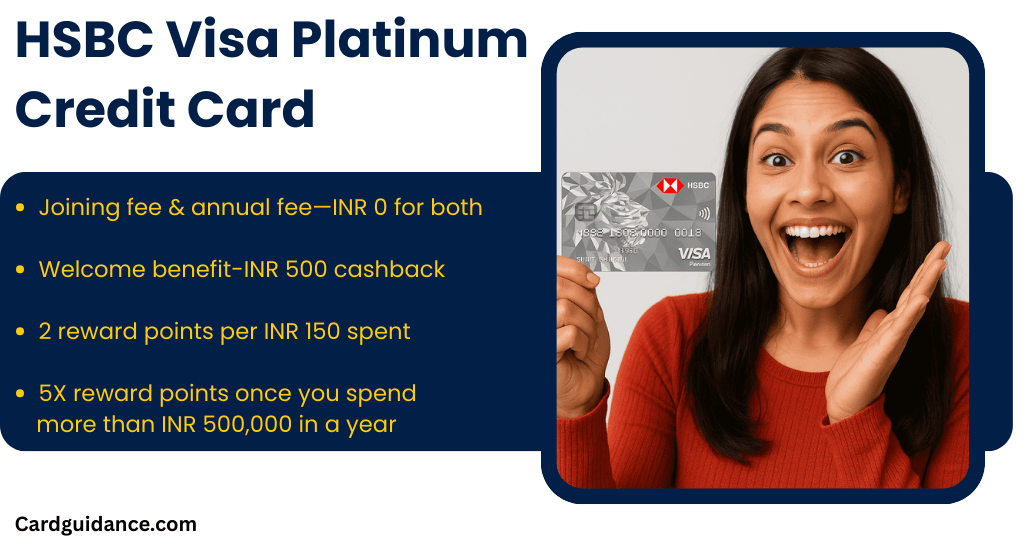

The joining fee and annual fee—you pay INR 0 for both. With this card, you will earn 2 reward points for every INR 150 spent.

You can use your HSBC Visa Platinum Credit Card for payments both online and in physical stores via Google Pay.

As a welcome benefit, you’ll receive INR 500 cashback after downloading the HSBC India Mobile App and spending INR 5,000 within the first 30 days. Additionally, you’ll get an INR100 Amazon e-gift voucher.

Check Your Eligibility here for HSBC Live+ Credit Card & Apply

Table of Contents

HSBC Visa Platinum Credit Card Highlights

| Feature | Details |

|---|---|

| Issuer | HSBC Bank |

| Network Type | Visa |

| Card Type | Reward Points |

| Joining Fee | INR 0 |

| Annual Fee | INR 0 |

| Joining Fee for Add-on Cardholder | Nil |

| Joining Benefits | ✔ Get ₹500 cashback when you download and log in to the HSBC Mobile Banking App and spend ₹5,000 within 30 days of card issuance. ✔ ₹100 Amazon e-gift voucher after completing the video KYC. |

| Best Suited For | shopping |

| Reward Rate | 2 reward points per INR 150 spent |

| Lounge Access | International – Not Available Domestic – Not Available |

| Fuel Surcharge Waiver | Save up to INR 3,000 annually on fuel surcharge waiver (For transactions between INR 400 to INR 4,000 at any petrol pump in India), the maximum waiver is INR 250 per month. |

The HSBC Visa Platinum Credit Card offers the following benefits:

- The main feature of the HSBC Visa Platinum Credit Card is 2 reward points for every INR 150 spent.

- You can use reward points for air miles, hotel stays, and gift cards.

- You will get 5X reward points once you spend more than INR 500,000 in a year (maximum 15,000 reward points per year).

- Lost Credit Card Liability: Up to INR 300,000

No reward points on the following categories: fuel-related expenses, e-wallets, and payment of property management fees.

Reward Points Redemption for HSBC Visa Platinum Credit Card

You can use reward points for air miles, hotel stays, and gift cards.

Convert HSBC Reward Points to Air Miles

Before converting your points into air miles, you must sign up for the airline’s frequent flyer program

| Airline (Frequent Flyer Program) | Conversion ratio |

|---|---|

| Air India (Maharaja Club), Air France–KLM (Flying Blue) British Airways (The British Airways Club), Etihad Airways (Etihad Guest) EVA Air (Infinity MileageLands), Japan Airlines (JAL Mileage Bank) Singapore Airlines (KrisFlyer), Qantas Airways (Qantas Frequent Flyer) Qatar Airways (Privilege Club), Thai Airways (Royal Orchid Plus) Vietnam Airlines (Lotusmiles) | 2 reward points = 1 miles |

| AirAsia (airasia rewards) | 1 reward points = 2 miles |

| Hainan Airlines (Fortune Wings Club) Turkish Airlines (Miles&Smiles) | 4 reward points = 1 miles |

| United Airlines (MileagePlus) | 3 reward points = 1 miles |

Convert HSBC Reward Points to Hotel Loyalty Points

| Hotel Group | Loyalty Program | HSBC Points = 1 Loyalty Point |

|---|---|---|

| Accor | ALL – Accor Live Limitless | 2 points |

| IHG Hotels & Resorts | IHG One Rewards | 2 points |

| Marriott International | Marriott Bonvoy | 2 points |

| Shangri-La | Shangri-La Circle | 10 points |

| Wyndham Hotels & Resorts | Wyndham Rewards | 2 points |

Lounge Access for HSBC Visa Platinum Credit Card

| Lounge Type | Access |

|---|---|

| International Lounge Program | No international lounge access |

| Domestic Lounge Program | No international lounge access |

Important Points to Be Noted for HSBC Visa Platinum Credit Card

- This credit card is not eligible for the fuel surcharge waiver for the first 90 days after credit card issuance.

- Reward points are valid only for 3 years

- Reward points can be redeemed for gift vouchers, airline miles by the primary credit cardholder only.

- Prepayment charges on foreclosure of EMI will apply at the rate of 3% on the outstanding loan amount (minimum of INR250)

Other Fees & Charges for HSBC Visa Platinum Credit Card

| Charge Type | Amount |

|---|---|

| Finance charges on extended credit | 3.75% per month (45% per annum) |

| Foreign exchange markup fees | 3.5% |

| Charge in case of a bounced cheque | INR 500 |

| Cash advance fee in India & overseas | 2.5% of the amount or a minimum of INR 300 |

| Free credit period | Up to 48 days |

| Overlimit fee | 2.5% of the overlimit amount or INR 500 (whichever is higher) + GST |

| Balance enquiry on credit card at other bank ATMs | Nil |

| Cash payment charges (credit card bill pay in cash) | INR 100 |

Eligibility for HSBC Visa Platinum Credit Card

- Age: 18 to 65 years

- Minimum annual income: ₹4 lakh (for salaried individuals)

- Must be an Indian resident

- Must live in one of these cities: Chennai, Delhi NCR, Pune, Noida, Hyderabad, Mumbai, Bangalore, Kochi, Coimbatore, Jaipur, Chandigarh, Ahmedabad, or Kolkata

Document Requirement for HSBC Visa Platinum Credit Card 📑

- Proof of Identity

- Proof of Address

- Proof of Income

Pros and Cons of HSBC Visa Platinum Credit Card

✅ Pros of HSBC Visa Platinum Credit Card

- It comes with zero joining fees and annual fees.

- INR 500 cashback when you download and log in to the HSBC Mobile Banking app and spend INR 5,000 within 30 days of card issuance, plus an INR 100 Amazon e-gift voucher

- 2 reward points for every INR 150 spent.

❌ Cons of HSBC Visa Platinum Credit Card

- This is not a cashback credit card, only a reward-point-based credit card, so you have to redeem reward points before they expire.

- No major benefits for travel or movies.

- The fuel surcharge waiver is capped at INR 250 per month.

Final Verdict: Should You Get the HSBC Visa Platinum Credit Card?

It’s fifty-fifty, because it is a lifetime free credit card and also gives you decent reward points every time you do a transaction.

If this is your first credit card, then it’s a yes for you.

If you already have a basic credit card, then no, because this card is not ideal for traveling—it does not provide any airport lounge access and has high foreign exchange markup fees.

HSBC Visa Platinum Credit Card Phone Banking numbers 📞

In India: 1800 267 3456/1800 121 2208

For calls from overseas to India: +91-40-61268002 or +91-80-71898002