The HDFC Swiggy Credit Card is a game-changer for frequent Swiggy users, offering 10% cashback on Swiggy food delivery, Instamart, Dineout, and Genie. Beyond that, it provides 5% cashback on select online spends and 1% cashback on offline transactions.

This HDFC Swiggy Credit Card will give you more benefits if you spend money on buying groceries, ordering food online, and dining out. It is a great choice for you because of the good cashback offers.

It comes with an annual fee of Rs. 500 only.

Maximum annual savings on the Swiggy platform: With 10% cashback every time, if you spend Rs. 15,000 in a month, you will save Rs. 1,500. In the year, Rs. 1,500X12=Rs.18000.

This card is a strong competitor of Amazon Pay ICICI and SBI Cashback Card and Axis Ace Credit card.

We will tell you the top 5 reasons why this HDFC Swiggy Credit Card might be a good choice for you.

Check Your EligibilityTable of Contents

Reason 1: 10% Cashback on Swiggy Platforms with the HDFC Swiggy Credit Card

10% Cashback is a pretty good cashback on all of your purchases made through the Swiggy app, like ordering food, groceries, or other services provided by Swiggy. This is the most important USP of this credit card.

How Does It Work?

- You will get ₹10 cashback per ₹100 spent on the Swiggy app.

- Maximum ₹1500 Monthly Cashback you can get (Applicable for spends up to ₹15,000)

- This Cashback will be settled in the Next month’s statement

- You will not get cashback for Swiggy Liquor, Swiggy Minis and for Swiggy Wallet Money.

- Transactions below Rs. 100 are not eligible for 10% cashback.

Reason 2: Get 5% Cashback on Other Online Platforms as well

How Does 5% Cashback Work?

You will earn ₹5 cashback on every ₹100 spent. Just spend ₹100 on eligible online platforms and get ₹5 cashback straight into your account.

Monthly Cashback Cap: Maximum Rs.1500 cashback you can earn in one month. If you spend Rs. 30 thousand in one billing cycle you will get 5% cashback which equals to Rs. 1500.

For a list of Eligible Merchant category codes (MCC), click here

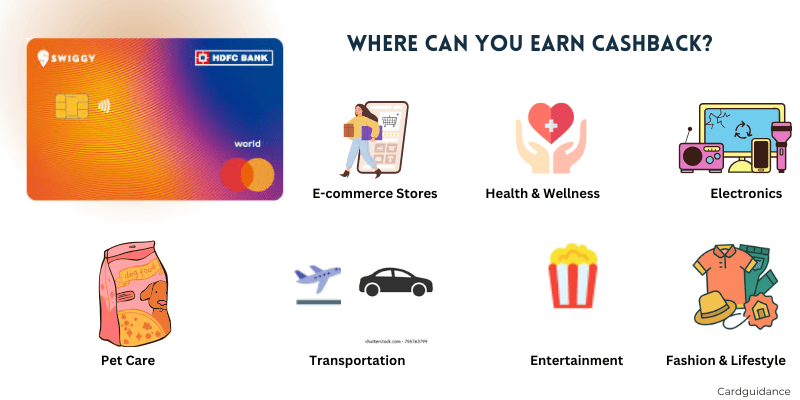

Areas Where Can You Earn 5% Cashback?

Here are some categories where you can earn 5% cashback:

(1) E-commerce Stores (2) Health & Wellness (3) Electronics (4) Pet Care (5) Transportation (6) Entertainment (7) Fashion & Lifestyle

5 % cashback is not available for: 5% cashback is not available on online grocery purchases and gift card purchases in any category

Reason 3: 1% Cashback on Your Everyday Offline Spends

You will get a flat 1% cashback on offline spending like dining out, paying for daily needs, and shopping at stores.

How It Works:

- 1% cashback on all eligible offline spends

- ₹500 monthly cashback limit

That means you have to spend Rs. 50,000 a month to get a maximum of Rs. 500 cash back.

Where cashback isn’t applicable:

Not all offline purchases are eligible. Cashback won’t be given on:

- Fuel

- Rent Payments

- EMI Transactions

- Wallet Top-ups

- Jewellery Purchases

- Government-related Transactions

Reason 4: Affordable Annual Fee + Attractive Welcome Benefits

As a welcome benefit, the HDFC Swiggy Credit Card will give you a free three-month Swiggy One membership, which is worth of Rs. 507.

Welcome Benefit:

- Get a complimentary 3-month Swiggy One Membership when you activate your card.

- If you already have a Swiggy membership, then your membership will be extended by another 3 months.

Affordable Fees

- Joining Fee: ₹500 + GST

- Renewal Fee: ₹500 + GST

Good News:- If you spend ₹2 lakh or more in a year, your renewal fee for the next year will be waived.

Click here to view details of Fees & Charges

Bonus Perk:

Another perk is that under the Master World platform, you will get up to 12 complimentary golf lessons per year at selected golf courses in India. This perk is not much attractive because most people do not play golf.

Reason 5: Free Swiggy One Membership = More Savings

If you regularly order food or groceries, the free Swiggy One Membership is a big reason to have HDFC Swiggy credit card.

Here’s What You Get with Swiggy One:

- Unlimited free deliveries on food and Instamart groceries

- Extra discounts exclusive to Swiggy One members

- Faster deliveries with priority service

Final words: Why should you have HDFC Swiggy credit card?

This card offers very good cashback, 10 % cashback on Swiggy food delivery, Instamart, Dineout, and 5% cashback on select online spends and 1% cashback on offline transactions. Your joining fee is easily covered with these perks.

This card gives you really great value for your money.

👉 Also Read: SBI Cashback Credit Card Review