HDFC Bank Revises Credit Card Charges for High-Value Transactions in categories like Gaming, Wallet Loading, Utilities, Rent, Fuel, Education, and Insurance.

Read the full article to know how these charges will impact the use of your credit card, and you will know the new HDFC credit card charges for 2025.

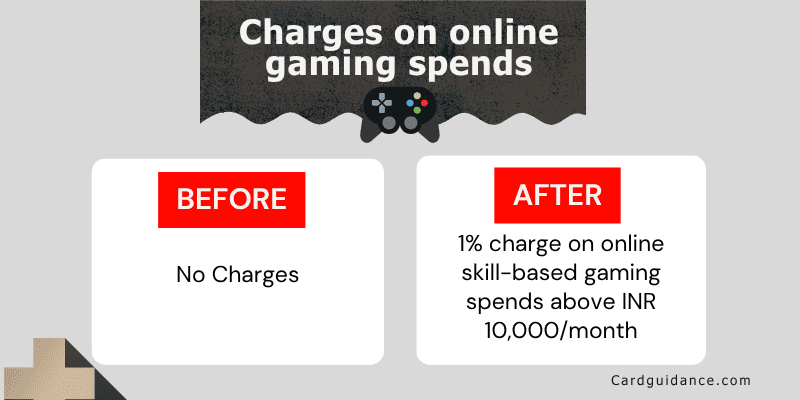

(1) Online Skill-Based Gaming Transactions

Transactions on platforms like Dream11, RummyCulture, Junglee Games, or MPL are now chargeable at 1%. There is no charge if transactions are below INR 10,000, but if the amount exceeds INR 10,000, then 1% of the total transaction value will be charged, not just the amount over INR 10,000.

If you spend more than INR 10,000 in a month on these platforms, a 1% charge will apply. This fee is calculated on the entire gaming spend for the month, not just the excess amount.

Maximum monthly charge: INR 4,999.

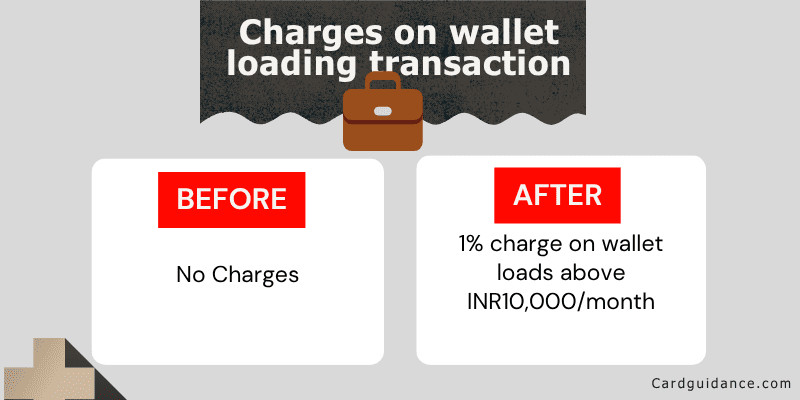

(2) Wallet Loading Transactions

If you add money to wallets such as PayTM, Mobikwik, Freecharge, or Ola Money using an HDFC credit card, you now have to pay a 1% charge if your total monthly wallet load exceeds INR 10,000.

- Maximum monthly charge: INR 4,999.

- No wallet transaction charges apply for PayZapp.

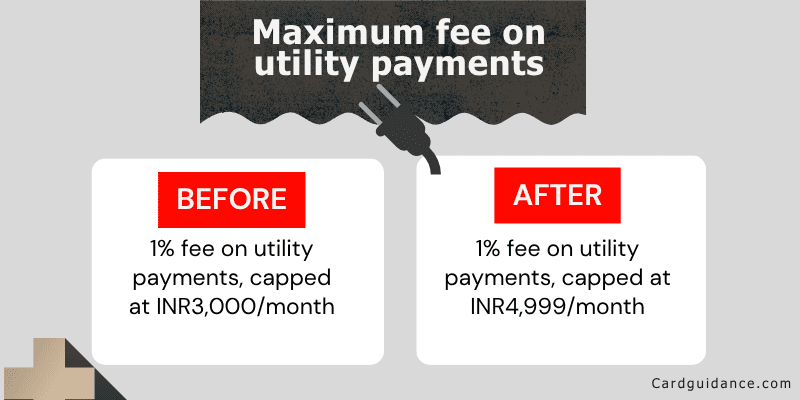

(3) Utility Transactions

If you pay your utility bills through your credit card, there is a 1% charge if your total utility bill payments exceed INR 50,000 in a month. However, insurance payments are not chargeable.

Maximum monthly charge: INR 4,999.

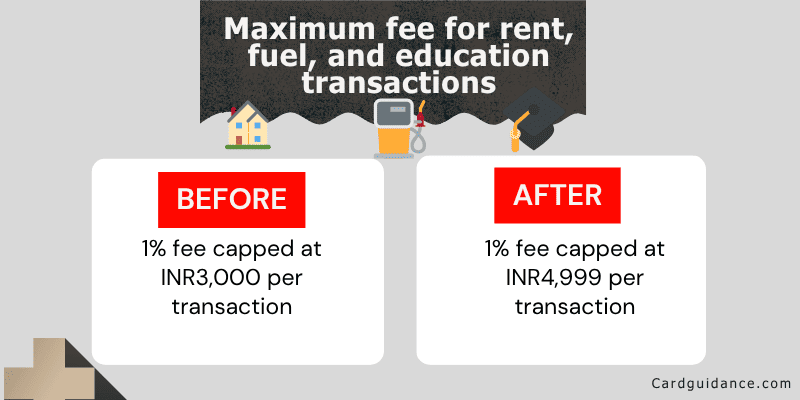

(4) Charges Upper Cap Revision for Rent, Fuel & Education

The maximum charge per transaction has been capped at INR 4,999 for the following categories:

- 1% charge continues to apply for rent payments and fuel payments (only if the transaction value is more than INR 15,000).

- Education Payment: 1 % charge only applies if the payment is made through third-party apps.

(No charge if payment is done via college/school websites or POS terminals.)

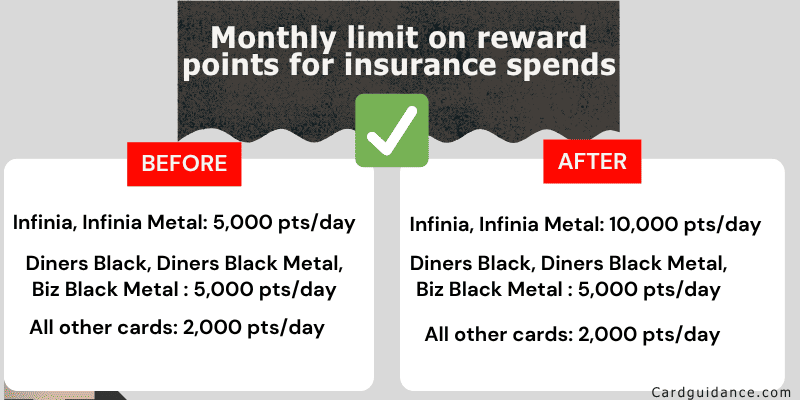

(5) Insurance Transactions

Paying insurance premiums with HDFC credit cards will continue to earn reward points, but they are now capped at 2,000 points per month.

- For Infinia and Infinia Metal credit cards, reward points are capped at 10,000 points per month.

- For Dinners Black, Dinner Black Metal, and Biz Black Metal credit cards, reward points are capped at 5,000 points per month.

- For all other credit cards, reward points are capped at 2,000 points per month.