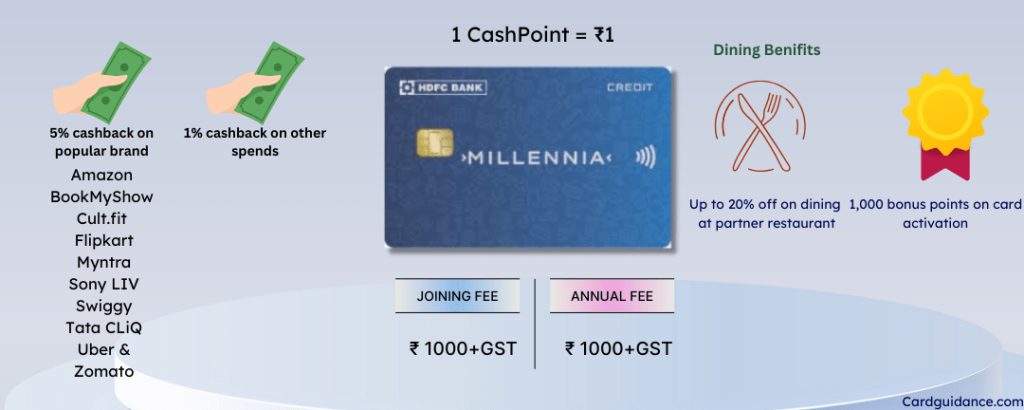

The HDFC Bank Millennia Credit Card is a good choice for online shopping because it offers 5% cashback on top brands like Amazon, BookMyShow, Cult.fit, Sony Liv, Flipkart, Swiggy, Zomato, Uber, Tata CLiQ, and more online platforms.

Get a 10% additional discount on Swiggy Dineout up to Rs. 500. Maximum two times in a month. The minimum order value is Rs. 2000.

The best part about this credit card is that there is no minimum transaction limit.

The annual fee is Rs. 1000, which can be waived on annual spending of Rs. 1 lakh. The cashback is in cashPoints form, which can be redeemed for statement credit, flight and hotel bookings, or HDFC’s rewards catalog.

The HDFC Bank Millennia Credit Card is a full, feature-packed cashback credit card. Let’s dive into its features, benefits, and charges in this detailed review.

Table of Contents

HDFC Bank Millennia Credit Card Highlights

| Feature | Details |

|---|---|

| Issuer | HDFC Bank |

| Network Type | Visa |

| Card Type | Cash Back |

| Joining Fee | ₹1000+GST |

| Annual Fee | ₹1000+GST (Waived on spending Rs. 1 lakh) |

| Joining Fees for add-on cardholder | Lifetime free |

| Joining Benefits | Pay your membership fee and get reward points equivalent to the fee amount |

| Best Suited For | Cashback |

| Reward Rate | 1% on retail spend 5% on the top ten online merchants in India |

| Lounge Access | Complementary lounge access on the Millennia credit card is discontinued effective midnight of 30th November 2023. |

| Fuel Surcharge Waiver | 1% fuel surcharge waiver across all fuel stations up to INR 250 per statement cycle. On a minimum transaction of ₹400 & a maximum transaction of ₹5,000. |

| Interest-free period | Up to 50 days |

Cashback benefits of the HDFC Bank Millennia Credit Card

| Category | Cashback Earned | Monthly Capping |

|---|---|---|

| Popular Brands (Amazon, Flipkart, Myntra, Swiggy, etc.) | 5% Cashback (CashPoints) | Rs. 1,000 CashPoints per cycle |

| All Other Spends | 1% Cashback (CashPoints) | 1,000 CashPoints per cycle |

| Redemption Against Statement Balance | 1 CashPoint = ₹1 | No Limit |

| Redemption for Flight/Hotel Bookings (SmartBuy) | 1 CashPoint = ₹0.30 | No Limit |

| Redemption for Product Catalog | 1 CashPoint = Up to ₹0.30 | No Limit |

| Redemption for Airmiles | 1 CashPoint = 0.30 Airmiles |

Additional Benefits of HDFC Bank Millennia Credit Card

- Earn 1,000 bonus cash points upon payment of the joining fee.

- Flat Rs. 200 discount on Swiggy Dineout using coupon code HDFCCARDS on a minimum Rs. 2000 transaction.

- Annual Fee Waiver: Spend ₹100,000 in a year to get your annual fee waived.

- Exclusive Dining Discounts: Save up to 20% on restaurant bills with Swiggy Dineout.

- Fuel Surcharge Waiver: Get a 1% waiver on fuel transactions ranging between ₹400 and ₹5,000, capped at ₹250 per statement cycle.

Lounge Access 💺

Complementary lounge access on the Millennia credit card is discontinued effective midnight of 30th November.

Fees & Charges for HDFC Bank Millennia Credit Card 💵 ✨

| Charge Type | Amount |

|---|---|

| Joining Fees | ₹1,000 |

| Annual Fees | ₹1,000 (waived off for annual spends of ₹100,000 or more in the previous year) |

| Finance charges on extended credit | 3.75% per month (45% per annum) |

| Foreign Exchange Markup fees | 3.5% |

| Cash advance limit | Up to 40% of the credit limit |

| Overlimit Fee | 2.5% of the over-limit amount or ₹500 (whichever is higher)+ applicable GST |

| Cash payment charge | ₹100 |

| Cashback redemption fee | ₹50 per redemption request |

Eligibility

- Age: 21 to 40 years

- Salaried: Minimum monthly income: ₹35 K (for salaried individuals)

- Self-employed: Minimum annual income ₹6 Lakhs as per ITR

- Must be an Indian resident

Documents Requirement 📑

- Proof of Identity: Aadhaar, PAN, Passport

- Proof of Address: Utility bill, Aadhaar, Voter ID

- Proof of Income: Salary slip, ITR

Pros & Cons ⚖️

Pros of HDFC Bank Millennia Credit Card

- 5% cashback on top online brands like Amazon, Flipkart, and Myntra.

- As a welcome bonus, you will get Cashpoints worth the joining fee on activation.

- The annual fee will be waived after Rs.1 lakh is spent.

Cons of HDFC Bank Millennia Credit Card

- A maximum of Rs. 1,000 cashback can be earned in a month with the 5% cashback segment. On other non-partner transactions, earn just 1%.

- There is no cashback on utility bills and rent payments.

- Complementary lounge access is not available. But if you spend Rs. 1 lakh or more in one calendar quarter, then either user can opt for a Dreamfolks airport lounge access voucher or Rs.1000 voucher from the available list of brands.

Final Verdict: Should You Get This Card?

Yes, the HDFC Bank Millennia Credit Card offers good cashback: 5% cashback on popular brands and 1% cashback for other spending. Your joining fee is easily covered with the welcome bonus.

Along with that, you will get an additional 10% discount on Swiggy Dineout using coupon code HDFCCARDS.

There are always great offers available on Flipkart and Amazon, where you can get no-cost EMI on the HDFC credit card.

If you are looking for unlimited cashback, you can consider alternatives like the SBI Cashback Credit Card or HDFC Swiggy Credit Card, which offer 5% cashback on all online spending (excluding some categories).

Click here to learn more terms and conditions

Apply HDFC Bank Millennia Credit Card

Apply NowHDFC Bank Millennia Credit Card Phone Banking Numbers 📞

- HDFC Phone Banking numbers in India: 1800 1600 or 1800 2600

- For calls from overseas to India: +91 22 61606160

- Email address: [email protected]

List of Credit Cards Similar to HDFC Bank Millennia Credit Card

- SBI Cashback Credit Card

- Flipkart Axis Bank Credit Card

- Amazon Pay ICICI Credit Card

- Axis Ace Credit Card

- HDFC Swiggy Credit Card

Frequently Asked Questions (FAQs)

What is the annual fee, and how can I get it waived?

The card has an annual fee of ₹1000 with GST. However, this fee is waived if you spend ₹100,000 or more in the preceding year.

What is the foreign currency transaction fee for this card?

A foreign exchange markup fee of 3.5% is applicable on transactions made in foreign currency.

When do unredeemed CashPoints expire on the HDFC Millennia Credit Card?

Unredeemed CashPoints will expire 2 years after they are earned, so it’s important to redeem them before they lapse.

Is there a limit on redeeming CashPoints for cashback on the HDFC Millennia Credit Card?

Yes, effective 1st February 2023, cashback redemption is capped at 3,000 CashPoints per calendar month.

What is the minimum CashPoint balance required for redemption

Minimum 500 cashpoints in the statement.