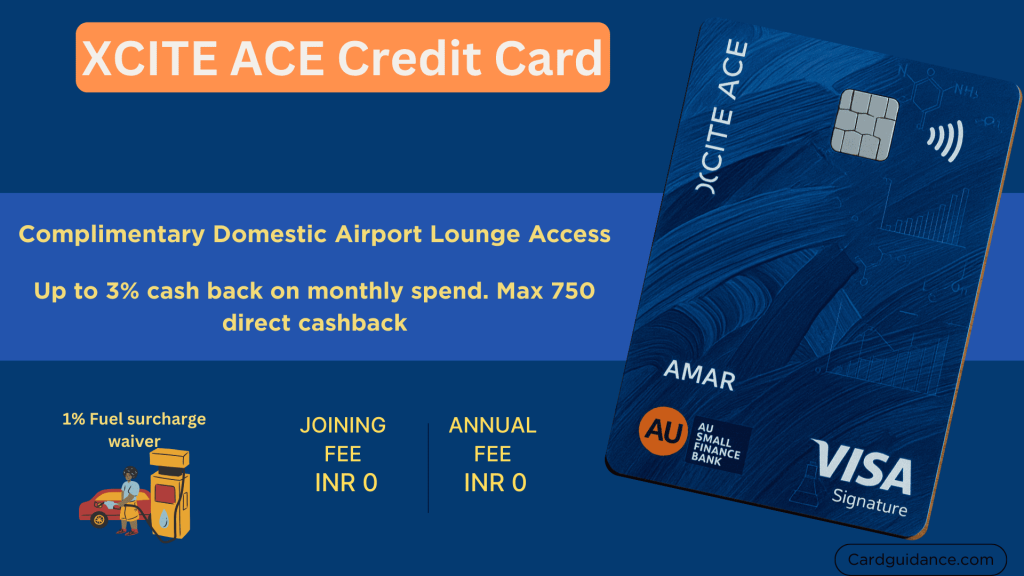

The AU Bank Xcite Credit Card is a lifetime free credit card — there are no joining or annual fees. This is based on the SwipeUp platform.

What is the SwipeUp platform?

It means if you have an old credit card from another bank, then under the SwipeUp platform, AU Bank will upgrade your old credit card to a new upgraded credit card with exciting cashback, higher reward points, increased credit limit, and other benefits with the Xcite series of credit cards.

It offers a higher credit limit along with up to a maximum of INR 750 cashback per month, which is automatically adjusted in your monthly statement.

The best part of the AU Bank Xcite Ace Credit Card is that you do not have to worry about redeeming reward points- this card will directly credit cashback in your monthly statement.

This card also provides complimentary access to domestic and international airport lounges, as well as railway lounge access. Read the full article to know more

Key Highlights of the AU Bank Xcite Ace Credit Card

| Feature | Details |

|---|---|

| Joining Fee / Issue Fee | Lifetime Free |

| Renewal Fee | Zero (No Annual Charges) |

| Best suited for | Shopping & Cashback |

| Welcome Benefits | No welcome benefits |

| Cashback | 1% -3% on eligible spends |

| Card Network | Visa |

Table of Contents

AU Xcite Ace Credit Card Benefits and Features

- Airport Lounge Access: You have to spend a minimum of INR 20,000 in one quarter to become eligible for complimentary Domestic Airport Lounge Access in the same quarter. Then you are eligible for 2 free lounge accesses, only for the primary cardholder, not for the add-on card.

- A total of 8 complimentary domestic airport lounge accesses per year.

Please check here for the complete airport list where you can enjoy free lounge access.

- Railway Lounge Access: You will get 2 complimentary railway lounge visits per quarter (a total of 8 free visits per year). Only 2 hours of entry and stay.

- Fuel Surcharge Waiver: 1% on fuel surcharge across all petrol pump transactions between INR 400 and INR 5,000 (max INR 200 per month).

- Complementary device protection: Get a free 1-year mobile and tablet screen damage protection and a complimentary 1-year extended warranty on white goods.

- Silver Spoon Dining Program: Up to 30% off on selected 300+ partnered restaurants in 30 cities.

Comprehensive Protection Cover:

| Air Accidental Cover | INR 50 Lakhs |

| card liability cover | Zero liability for any fraudulent |

| Credit Shield | Up to INR 2 Lakhs |

| Purchase Protection | Up to INR 25,000 |

AU Xcite Ace Credit Card: Fees & Charges

| Fee Type | Details |

|---|---|

| Joining Fee (Primary & Add-on Card) | Lifetime Free |

| Annual Maintenance Fee | No Fee |

| Cash Withdrawal Fee | 2.5% of the withdrawal amount or INR 500 (whichever is higher) |

| Fuel Surcharge Waiver | 1% fuel surcharge refund (Max INR 200 per month) (GST on fuel surcharge will not be reversed) |

| Interest-Free Period | Up to 48 days (Only for online transactions, not valid for cash withdrawals) |

| Interest Charges (Revolving Credit) | 3.59% per month (43.08% per annum) + GST |

| Minimum Due | 5% of the total bill amount (including previous dues) or INR100 (whichever is higher) |

| Out Station Check Processing Fee | INR 25 per check |

| Foreign Currency Transaction Markup | 3.49% of the total transaction amount |

| Duplicate Physical Statement Fee | INR 100 per request |

| EMI Conversion Charges | Instant EMI – INR 199 + GST |

| Cash Advance Limit | Up to 40% of the total credit card limit |

AU Xcite ACE Credit Card: Cashback Rewards on Spending

Maximum Cashback: ₹750 per month

No cashback on rent payments, fuel purchases, and wallet reloads.

| Spending Amount | Cashback Earned |

|---|---|

| Less than INR 7,500 | No cash back |

| INR 7,500 – INR 12,499 | 1% Flat Cashback |

| INR 12,500 – INR 20,000 | 2% Flat Cashback |

| More than INR 20,000 | 3% Flat Cashback |

AU Xcite ACE Credit Card – Late Payment Charges

Late payment charges apply if the minimum due is not paid by the due date by the cardholder.

| Total Amount Due / Statement Balance | Late Payment Charges |

|---|---|

| INR 100 or less | No Charges |

| INR 101 – INR 500 | INR 100 Fixed Charge |

| INR 501 – INR 5,000 | INR 600 Fixed Charge |

| INR 501 – INR 10,000 | INR 700 Fixed Charge |

| INR 10,001 – INR 20,000 | INR 800 Fixed Charge |

| INR 20,001 – INR 50,000 | INR 1,100 Fixed Charge |

| More than INR 50,000 | INR1,300 Fixed Charge |

Eligibility for Xcite Ace Credit Card

- Self-Employed: 25 to 65 years

- Salaried: 21 to 60 years

- Add-on cardholder: Above 18 years

Document Requirements for Xcite Ace Credit Card

- Proof of Identity

- Proof of Address

- Proof of Income

AU Bank Xcite Ace Credit Card Customer Care

For any queries related to your AU Bank Xcite Ace Credit Card, you can contact customer support through the following channels:

- Customer Care Helpline: 1800 1200 1200

- Email Support: [email protected]

Frequently Asked Questions (FAQs) for AU Xcite Ace Credit Card

Is the cash withdrawal limit the same for all AU Bank credit cards?

No, the cash withdrawal limit varies by credit card variant. For the Xcite series, the cash withdrawal limit is up to 40% of the total credit card limit.

What is the interest-free period for the AU Bank Xcite Ace Credit Card?

You can enjoy an interest-free period of up to 48 days, applicable only for purchases (not valid for cash withdrawals).

What is the maximum cashback available?

The maximum cashback you can earn per month is 3% or ₹750, whichever is lower.