The ICICI Bank Times Black Credit Card is a super-premium co-branded metal credit card by ICICI Bank and The Times of India Group, launched in December 2024. They also launched a new ad film recently, in which they told the origin of this credit card.

This card is designed for Ultra High Net Worth Individuals (UHNI), which comes with travel benefits, luxury lifestyle, and exclusive access to “The Quorum Club”.

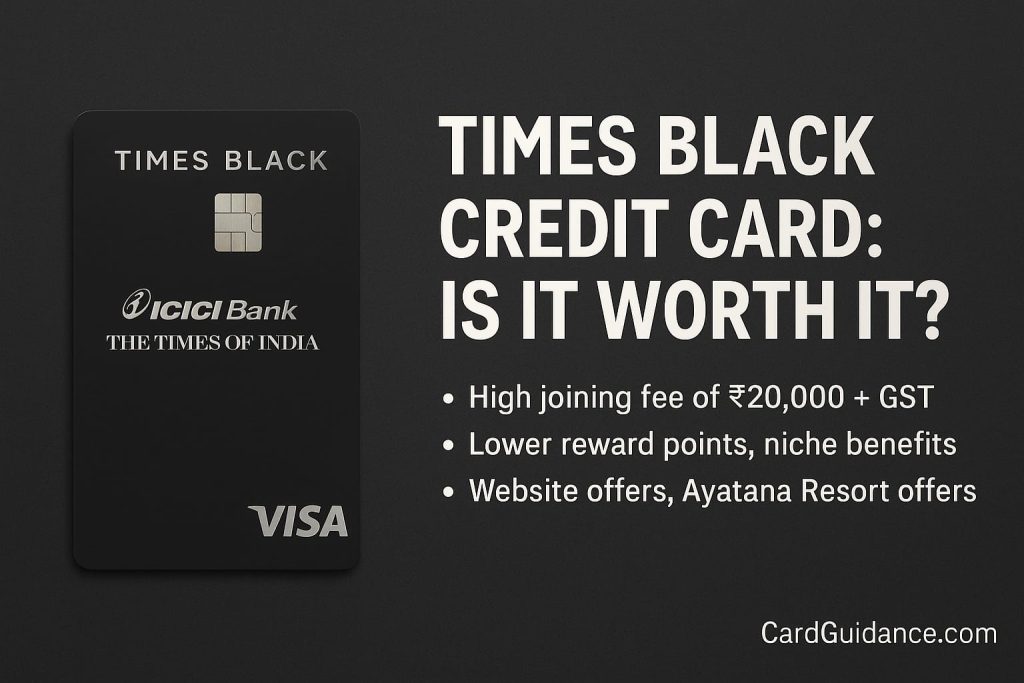

Times Black credit card comes with a high joining fee of Rs. 20,000 + GST, and cardholders can get reward points from 2% to 2.5%. It provides unlimited domestic and international airport lounge access.

1 ICICI Reward Point is valued between INR 0.40 and INR 1.00, depending on redemption.

My Opinion: Times Black credit card offers lower reward points and few services which most of us are not going to use, like Klook offers and Ayatana Resort offers.

If you’re unsure whether you qualify, you can visit the official ICICI Bank Times Black page

Table of Contents

Important Fees and Charges for Times Black Credit Card

| Feature | Details |

|---|---|

| Issuer | ICICI Bank |

| Network | Visa |

| Card Type | Reward Points |

| Joining Fee | INR 20,000 + GST |

| Annual Fee | INR 20,000 + GST (Reversed on spending INR 25 lakh in a year) |

| Add-on Card Fee | Nill |

| Fuel Benefit | 1% fuel surcharge waiver (up to INR 1,000 per month) |

| Best Suited For | Travelling and Lifestyle |

| Reward Rate | 2.5% Reward Points on International spends 2% Reward Points on Domestic spends |

| Foreign currency transactions markup Fee | 1.49% + GST |

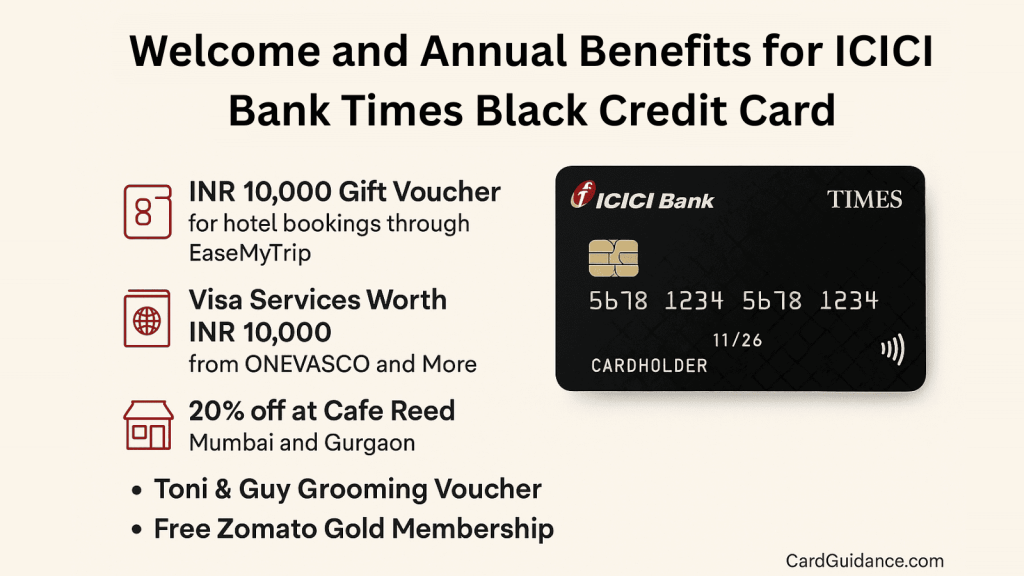

Welcome and Annual Benefits for ICICI Bank Times Black Credit Card

Let me be real with you. These benefits? They’re not the kind everyone can use. They feel pretty niche, and to be honest, they don’t exactly scream “wow, what a great deal!” for a credit card claiming to offer premium value. Here’s what they’re offering:

- A INR 10,000 gift voucher for hotel bookings through EaseMyTrip. Sounds great-if you already planned a trip and were going to book through that platform.

- Visa services from ONEVASCO and More, worth INR 10,000. Includes things like doorstep visa assistance and lounge access. Cool, if you’re actually applying for a visa soon.

- The Quorum Club gives 20% off at Cafe Reed in Mumbai and Gurgaon, exclusive access to some events, and 20% off on standard membership. Again, only useful if you live in or visit these cities often.

- Toni & Guy grooming voucher worth INR 3,000. Not bad if that’s your go-to salon.

- A free Zomato Gold annual membership. Okay, decent-but honestly, doesn’t feel like a major win.

- INR 1,000 voucher from Interflora for floral gifting. Nice, but a one-time thing.

- No cancellation charges: There are zero cancellation charges for the first two domestic flight, hotel bookings, and movie tickets, for a maximum of up to INR 12,000. Valid only for 4-star and 5-star hotels.

Milestone Benefits for ICICI Bank Times Black Credit Card

| Spend Amount | What You Get |

|---|---|

| INR 2 Lakh | INR 10,000 voucher from KLOOK for travel bookings |

| INR 5 Lakh | A one-time luxury sedan airport transfer |

| INR 10 Lakh | INR 10,000 voucher for Tata CLiQ |

| INR 20 Lakh | Complimentary 1-night stay at Ayatana Resorts, worth up to INR 20,000 |

| INR 25 Lakh | Annual Fee will be waived |

Is it actually worth it?

Let’s be real—most of these rewards don’t feel all that rewarding unless you already planned to spend big. Here’s how it really breaks down:

- INR 2L spend for a INR10K voucher from KLOOK is okay, if you’re already booking through them. It’s a 5% return—but that only matters if you’re into using that platform.

- INR 5L for a single airport ride? That’s kind of laughable. Feels like a basic freebie dressed up in a tux.

- INR 10L spend for a INR 10K Tata CLiQ voucher? That’s just a 1% reward. Not impressive for that kind of spend.

- INR 20L spend for a one-night stay worth INR 20K… again, 1% back. And it’s only at one resort chain, so your options are limited.

Honestly, the benefits feel more symbolic than substantial. They sound luxe, but they’re not adding a whole lot of real value—especially compared to what you’d expect at those spending levels.

Reward Points – How They Work

Now let’s talk about the reward points game on this card. On paper, it looks decent—but once you get into the details, there are a few things to keep in mind.

Earning Reward Points

- You’ll earn 2% in reward points on domestic spending, even for things like insurance payments, utility bills, education fees, and government-related transactions.

- Spend internationally and you’ll get 2.5% back in reward points-which is a bit better.

Redeeming Reward Points

- Each point you collect can be redeemed for up to INR 1–but if you choose cashback instead, each point is only worth INR 0.40.

A Few (Important) Fine Print Details

Let’s be honest, the terms are where it gets a little sticky:

- Only eligible retail purchases earn points-so don’t count on getting rewarded for everything.

- Fuel purchases? No points at all.

- For transactions in categories like insurance, education, utilities, and government payments, you can earn a maximum of 5,000 points per month.

- If you don’t use your card for over a year, your hard-earned reward points… they just vanish.

- Rent payments? Starting from your second rent transaction in a month, there’s a 1% fee, if you’re paying through third-party apps.

- Be cautious with currency: even if you pay in INR, if the merchant is registered overseas (or it’s an international terminal), you get hit with a 1.49% markup.

- Making education payments through apps like CRED, Cheq, or MobiKwik won’t earn you any points. But if you pay directly through a school or college’s own site or swipe at a POS terminal, you’re good.

Lounge Access for ICICI Bank Times Black Credit Card

This credit card will provide you unlimited Airport Lounge Access for primary and add-on card holder.

| Lounge Type | Access |

|---|---|

| International Airport Lounge Program | Unlimited (Via Visa) |

| Domestic Airport Lounge Program | Unlimited (Via Priority Pass) |

Eligibility & Documents Required

The ICICI Bank Emeralde Private Metal Credit Card

- Minimum age: 21 years

- Residence: Must be permanent resident of India.

- Banking Requirements: Indian or multi national bank’s saving or current account in India

Pros and Cons of ICICI Bank Times Black Credit Card

| PROS | CONS |

|---|---|

| Unlimited lounge access (domestic + international) | High joining/annual fee |

| Low Forex Markup Fee | Poor Reward Rate |

| Zero cancellation fees | No guest lounge access |

| High-value insurance cover |

Verdict: Should You Get the ICICI Bank Times Black Credit Card?

No, this card is mainly designed for frequent travelers who want to use unlimited airport lounge access. The joining fee is very high, with challenging milestone benefits. Times Black credit card is the first card of the Times group, which provides you many benefits — but not direct benefits.

1 ICICI Reward Point = INR 1 to 0.4

You are getting 2%-2.5% reward points, but that alone may not be sufficient to justify such a high joining fee.

You can consider another credit card like ICICI Bank Emeralde Private Metal Credit Card.

ICICI Bank Times Black Credit Card Customer Care

- Toll‑free (MTNL/BSNL): 1800 26 70731

- Standard rate: 022 6787 2016

This is the exclusive i‑Assist line for high-end cardholders like Times Black.

General Credit Card Helpline (available to all ICICI credit cardholders)

- Toll‑free (India): 1800 1080

- From abroad: +91‑22‑33667777

Is the ICICI Times Black Credit Card worth the INR 20,000 joining fee?

Yes, Only if you travel often and use premium benefits like lounge access. For most of us, the rewards are not justifing the high fee.

How do reward points work on the ICICI Times Black Credit Card?

You will get 2% on domestic and 2.5% on international spends. Points are worth INR 0.40-INR 1 depending on how you redeem them.

Does it offer unlimited airport lounge access?

Yes, unlimited lounge access both domestic and international is available for primary and add-on cardholders as well.

Are the milestone benefits useful?

The milestone targets are very high,They’re decent but only if you spend INR 2-INR 25 lakh annually.