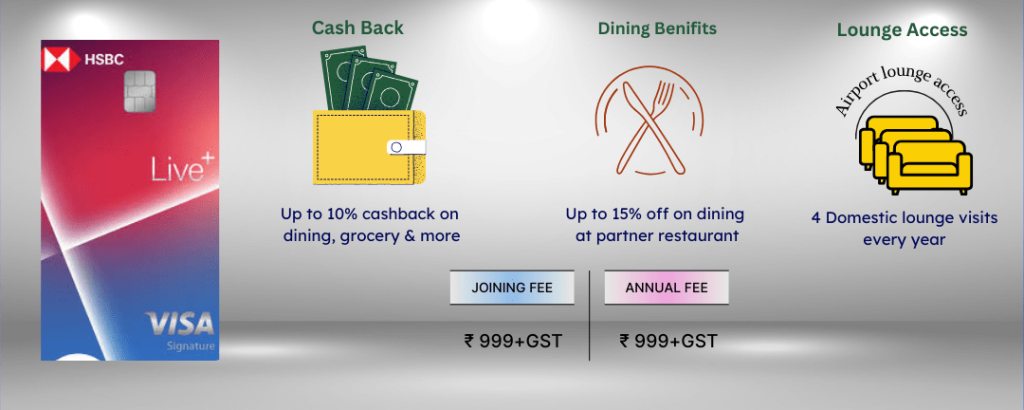

The HSBC Live+ Credit Card is accepted worldwide. This card gives 10% cashback on dining, groceries, and more. You can get up to 15% off on dining at partner restaurants. This card also offers unlimited 1.5% cashback on other spending.

As a welcome benefit, you will get INR 1,000 cashback after you download the app and spend INR 20,000 within the first 30 days, as well as an INR 100 Amazon e-gift voucher

This card can be used both domestically and internationally.

Table of Contents

HSBC Live+ Credit Card Highlights

| Feature | Details |

|---|---|

| Issuer | HSBC Bank |

| Network Type | Visa based on PayWave technology |

| Card Type | Cashback |

| Joining Fee | INR 999 + GST |

| Annual Fee | INR 999 + GST (Waived on spending ₹ 2 lakh) |

| Joining Fees for add-on cardholder | Nil |

| Joining Benefits | ✔ Get INR 1,000 cashback when you download and log in the HSBC Mobile Banking app and spend INR 20,000 within 30 days of card issuance. ✔ INR 100 Amazon e-gift voucher after completing the video KYC |

| Best Suited For | Cashback |

| Reward Rate | 1.5% on retail spend 10% on Dining, Food delivery, and Grocery spending (Max INR 1,000 per statement) |

| Lounge Access | International– N/A Domestic -4 complimentary lounge access, one per quarter |

| Fuel Surcharge Waiver | Not Available |

This card offers direct benefits.

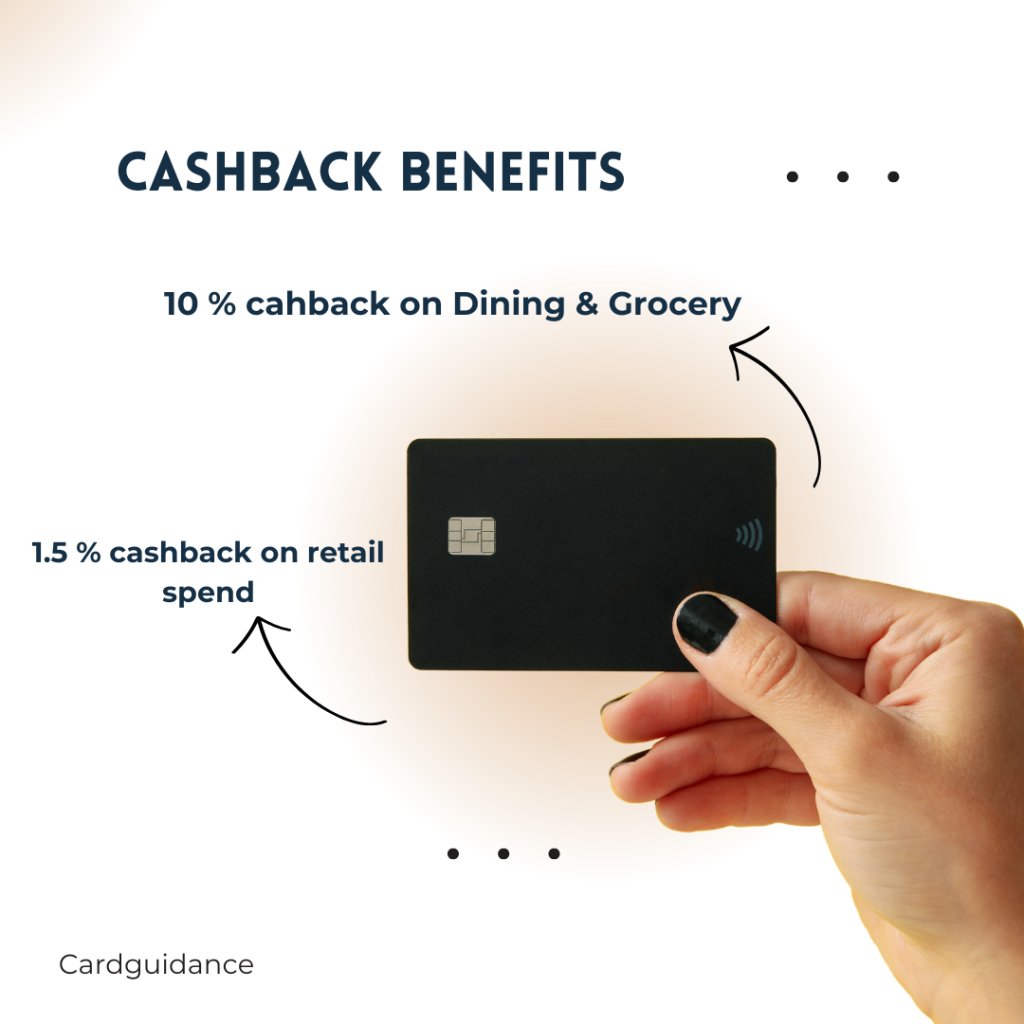

The main feature of the HSBC Live+ Credit Card is 1.5% unlimited cashback.

The cashback amount will be credited to your monthly statement within 45 days.

You get 10% cashback on all dining, food delivery, and grocery transactions (capped at INR 1,000 per billing cycle).

1.5% unlimited cashback is available on other spending.

No cashback on the following categories: fuel-related expenses, e-wallets, payment of property management fees, rental payments, education, and government-related transactions, insurance, jewelry, tolls and bridge fees, and money transfers.

Lounge Access for HSBC Live+ Credit Card💺

| Lounge Type | Access |

|---|---|

| International Lounge Program | No International Lounge access |

| Domestic Lounge Program | 1 complimentary domestic airport lounge visit per quarter |

Fees & Charges for HSBC Live+ Credit Card

| Charge Type | Amount |

|---|---|

| Joining Fees | INR 999 |

| Annual Fees | INR 999 (waived off for annual spends of ₹200,000 or more) |

| Finance charges on extended credit | 3.75% per month (45% per annum) |

| Foreign Exchange Markup fees | 3.5% |

| Charge in case of bounced cheque | INR 500 |

| Cash advance limit | Up to 20% of the credit limit |

| Overlimit Fee | 2.5% of the overlimit amount or INR 500 (whichever higher) + applicable GST |

| Cash payment charge | INR 100 |

Eligibility for HSBC Live+ Credit Card

- Age: 18 to 65 years

- Minimum annual income: ₹4 lakh (for salaried individuals)

- Must be an Indian resident

- Must live in one of these cities: Chennai, Delhi NCR, Pune, Noida, Hyderabad, Mumbai, Bangalore, Kochi, Coimbatore, Jaipur, Chandigarh, Ahmedabad, or Kolkata

Document Requirement for HSBC Live+ Credit Card 📑

- Proof of Identity

- Proof of Address

- Proof of Income

Pros & Cons of HSBC Live+ Credit Card ⚖️

✅ Pros of HSBC Live+ Credit Card

- 10% cashback on all dining and food delivery. If you spend INR 10,000 every month, then this card is a good choice for you.

- Cashback will be directly credited to your monthly statement account. No worries about the conversion of cash points.

- Low spending requirement to waive the annual fee.

- On other eligible transactions, get 1.5% cashback.

❌ Cons of HSBC Live+ Credit Card

- Cashback is limited to ₹1,000 per month at the 10% rate.

- No major benefits for travel or movies.

Final Verdict: Should You Get the HSBC Live+ Credit Card?

Yes, you should go for this card if you do not already have the Swiggy HDFC Credit Card.

📢 Best for:

- Good cashback, especially with no cap in the 1.5% cashback segment.

- If you frequently spend on groceries and dining

- If you spend INR 2 lakh annually, you can get a free annual fee waived

⚡Not ideal for:

- If you travel frequently, this card does not provide you major perks

👉 Also Read: SBI Cashback Credit Card Review

HSBC PhoneBanking numbers 📞

- HSBC Phone Banking numbers in India: 1800 267 3456/1800 121 2208

- For calls from overseas to India: +91-40-61268002 or +91-80-71898002

Frequently Asked Questions (FAQs)

What cashback benefits does this credit card offer?

This card gives 10% cashback on dining, food delivery, and grocery shopping, but you can earn a maximum of INR 1,000 per month. For all other purchases, you get 1.5% cashback with no limit.

Is there any limit on earning 1.5% cashback on regular spending?

No, the 1.5% cashback on other eligible spending is unlimited.

What is the annual fee, and how can I get it waived?

The card has an annual fee of INR 999. However, this fee is waived if you spend INR 200,000 or more in the preceding year.

What is the foreign currency transaction fee for this card?

A foreign exchange mark-up fee of 3.5% is applicable on transactions made in foreign currency.