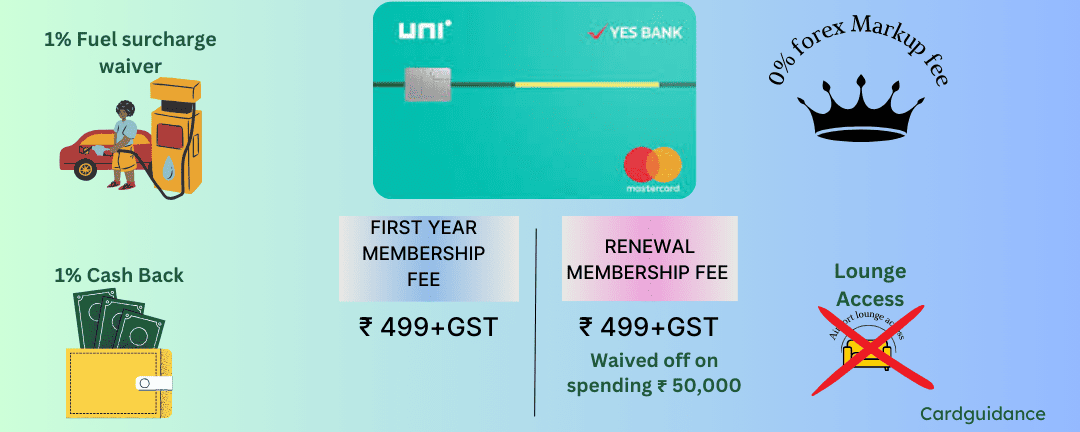

The Yes Bank Uni Credit Card is a basic credit card, which comes with a nominal joining fee and an annual fee of INR 500 only. It offers a 1% cashback on all spending, without any merchant restrictions.

The best benefit of this card is it charges zero forex markup fees, which makes it different from other basic cards.

The Yes Bank Uni Credit Card has benefits like an annual fee waiver and a 1% fuel surcharge waiver, which makes it a valuable credit card. Although this card does not give any free airport lounge access.

Table of Contents

Yes Bank Uni Credit Card: Key Highlights

| Feature | Details |

|---|---|

| Issuer | Collaboration of Yes Bank and UNI |

| Card Type | Mastercard |

| First-Year Membership Fee | INR 499 + Applicable Taxes (Waived on spending INR 5,000 within 30 days) |

| Renewal Membership Fee | INR 499 + Applicable Taxes (Waived on spending INR 50,000 within a year) |

| Travel Benefit | 0 % forex Markup fee |

| Best Suited For | International Transaction-Zero Forex Fees, and other regular spendings |

| Reward Rate | 1 % Cashback |

| Lounge Access | No |

| Fuel Surcharge Waiver | 1% Fuel surcharge waiver across all fuel stations, up to INR 500 per month |

| Free Movie Tickets | No |

Rewards & Cashback 💰

| Spend Category | Cashback |

|---|---|

| Fuel, Wallet load, rent, government transactions, cash withdrawal from ATMs, EMI Transactions, | No cashback |

| Departmental Store, Grocery Spend, Shopping | 1% cash back |

| Fuel | 1% fuel surcharge waiver across all fuel stations. Up to ₹500 per month (Fuel transactions up to INR 7,500 only) |

| Other Spends (Including International Transactions) | 1% cash back |

Lounge Access 💺

| Lounge Type | Access |

|---|---|

| International lounge access | No |

| Domestic lounge access | No |

Other Fees & Charges

| Charge Type | Amount |

|---|---|

| Interest Rate on Revolving Credit, Cash Advances, Overdue Amount | 3.99% per month (47.88% per annum) |

| Foreign Exchange Markup | Zero |

| Late Payment Fee | For Statement Balance Up to ₹100: ₹ Nill ₹101 to ₹500: ₹150 ₹501 to ₹5000: ₹500 ₹5001 to ₹25000: ₹750 ₹25,001 to ₹50,000: ₹1,150 above ₹50,000: ₹1,200 |

Click here to view other fees & charges and terms & conditions

Eligibility & Documents Required 📑

| Criteria | Requirement |

|---|---|

| Age for Primary Cardholder | 21 to 60 Years |

| Employment | Salaried or self-employed |

| Income | Min INR 25,000 per month or ITR of 7.5 lakhs and above |

| Documents Required | PAN Card, Aadhar, Income Proof, Address Proof |

| Residential Status | Indian Resident only |

How to apply for a Yes Bank Uni Credit Card online?

- Step 1: Visit https://www.yesbank.in website or the nearest branch.

- Step 2: Go to the “Cards” section and select “Credit Cards.”

- Step 3: Scroll down to find the Yes Bank Uni Credit Card and click on “Apply Now.”

- Step 4: Enter your date of birth (DOB), PAN card details, and full name.

- Step 5: Submit your details and wait for verification and approval.

- Step 6: Once approved, your credit card will be delivered to your registered address.

Pros & Cons ⚖️

✅ Pros of Yes Bank Uni Credit Card

- 1% fuel surcharge waiver across all fuel stations in India.

- Unlimited 1 % cashback on all eligible transactions.

- Zero forex markup fee.

- This card is accepted worldwide.

- Have contactless transactions with NFC-enabled technology.

❌ Cons of Yes Bank Uni Credit Card

- There is no complimentary airport lounge access.

- If you purchase fuel for more than INR 20,000, then a 1% fee plus taxes will be applied.

- 1% plus taxes on education fee payment.

Final Verdict: Should You Get This Card?

If this is your first credit card, then you can have this credit card.

The only thing that makes this card different from others is that it has zero forex markup fees.