The RBI just made another big move and yes, it is something that could actually impact our wallet. Here is a quick and easy look at what the June 2025 Monetary Policy means for regular people like you and me.

Table of Contents

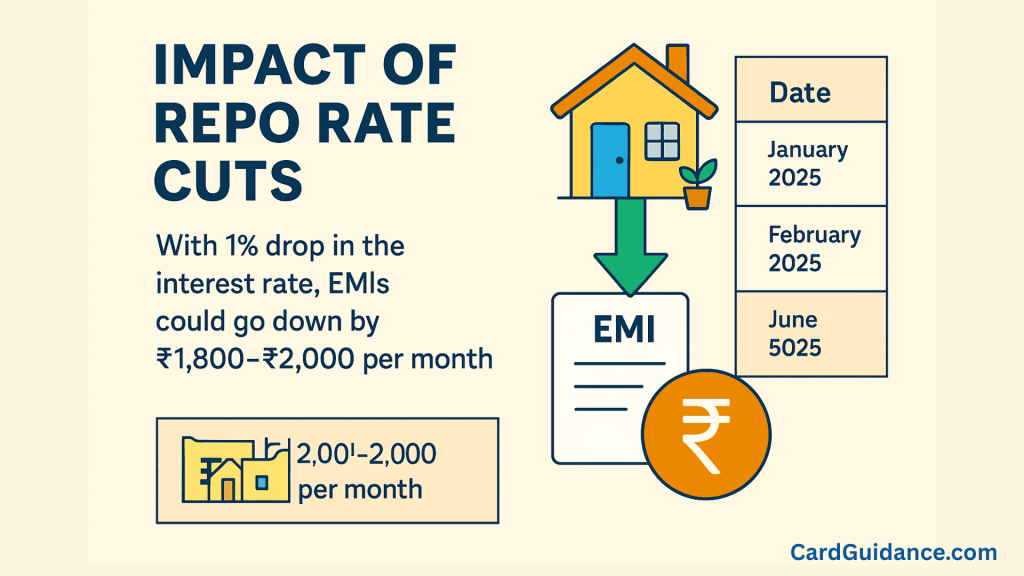

1. RBI cut the repo rate to 5.50%, down by 1% since January

The repo rate is the interest rate at which RBI lends money to banks. When this rate goes down, banks can also reduce the rates they charge you.

In January 2025, the repo rate was 6.50%. Now, after two cuts (one in Feb and one in June), it is down to 5.50%. If you are repaying a home loan, or thinking of starting a business, this is great news for you. EMIs will go down.

Example: Let is say you have a ₹30 lakh home loan. A 1% drop in the interest rate could save you ₹1,800–₹2,000 per month on your EMI.

| Date | Repo Rate (%) |

|---|---|

| January 2025 | 6.50 |

| February 2025 | 6.00 |

| June 2025 | 5.50 |

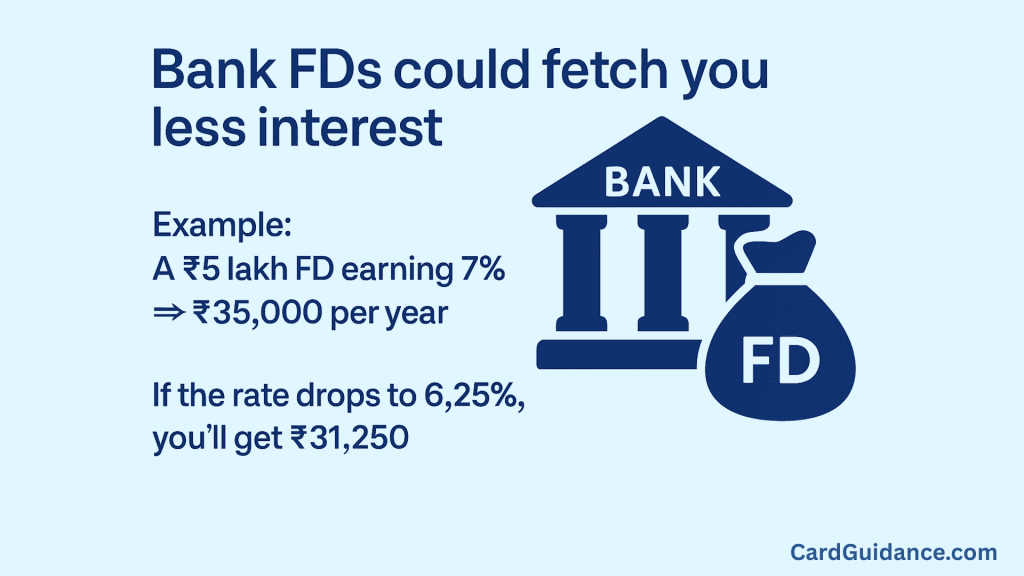

2. Loans May Get Cheaper, But So Could FD Returns

Since loans are cheaper, banks might also lower FD (fixed deposit) interest rates.If you depend on FDs for regular income (say, you’re retired or saving for a big goal), this might not be ideal. You might get less interest than before.

If you are planning to lock in a fixed deposit for 1–2 years, do it soon before rates drop further.

Example: A ₹5 lakh FD earning 7% today gives you ₹35,000 per year. If the rate drops to 6.25%, you’ll get only ₹31,250 – ₹3,750 less every year.

| Impact | What You Might See |

|---|---|

| Home Loans (floating) | Reduced EMIs over next few months |

| Personal Loans | Slight dip in interest rates |

| Fixed Deposits (FDs) | Lower returns expected soon |

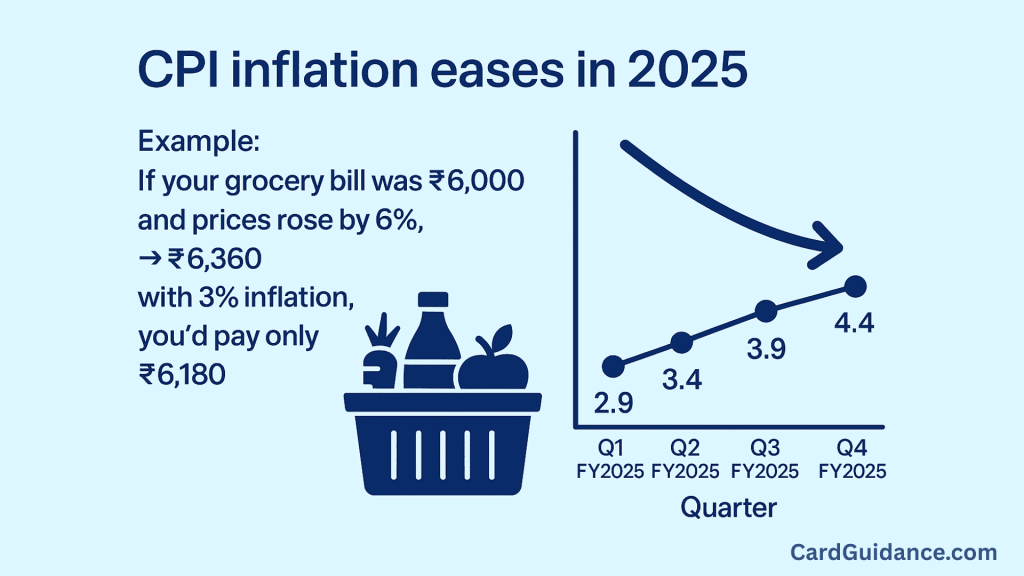

3. Inflation has slow down.

Here’s the good news: Prices aren’t rising like crazy anymore.

- Inflation was 3.2% in April 2025.

- RBI expects it to stay around 3.7% for the whole year.

You’re probably already noticing it, grocery shopping feels a bit lighter on the wallet. LPG, veggies, dal… prices are not climbing like they used to.

Example: If your monthly grocery bill was ₹6,000 last year and prices rose by 6%, that is ₹6,360 this year. But with 3% inflation, you are only spending ₹6,180. That is ₹180 saved every month, or over ₹2,000 a year.

| Quarter | CPI (Consumer Price Index inflation) Inflation (%) |

|---|---|

| Q1 FY2025 | 2.9 |

| Q2 FY2025 | 3.4 |

| Q3 FY2025 | 3.9 |

| Q4 FY2025 | 4.4 |

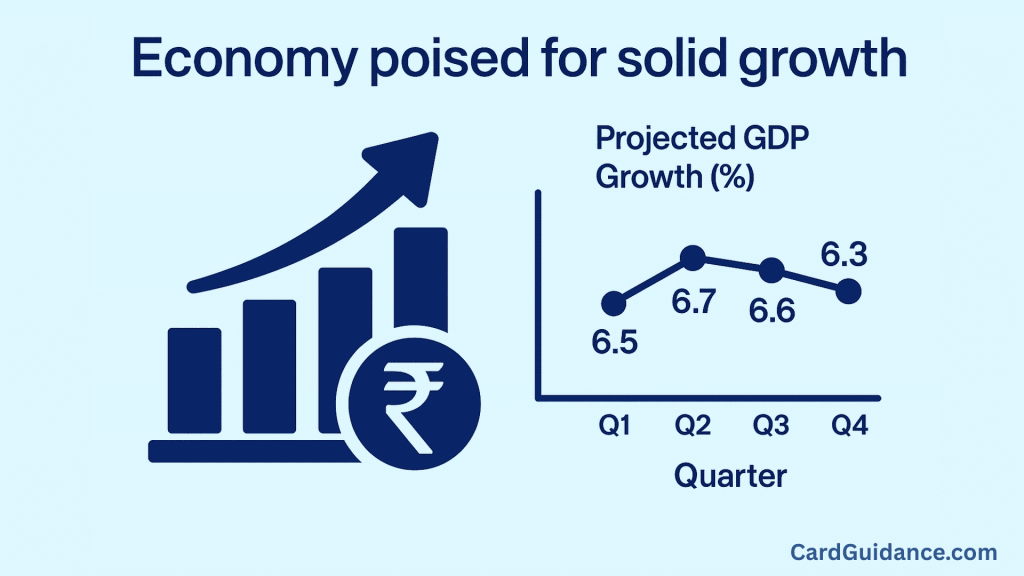

4. The Economy is still growing at 6.5%

Even with global uncertainties (like wars, oil prices, trade issues), India is doing well.

RBI is confident we’ll see 6.5% GDP growth this year.Jobs, salaries, and business opportunities should stay stable. The service sector is buzzing, and rural spending is also holding up.

| Quarter | Projected GDP Growth (%) |

|---|---|

| Q1 | 6.5 |

| Q2 | 6.7 |

| Q3 | 6.6 |

| Q4 | 6.3 |

5. Here is how it all affects you personally

| If You Are… | This Might Happen… |

|---|---|

| A home loan borrower | EMIs could reduce in the next cycle |

| A saver (FDs, RDs) | Interest rates may drop—consider locking now |

| A small business owner | Lower loan costs = more breathing room |

| A stock market investor | More liquidity often means improved sentiment |

| Budgeting your expenses | Inflation staying low means prices more stable |

Real-Life Example: Ramesh, a salaried employee in Mumbai, was paying ₹22,000 EMI. After this rate cut, he refinanced and brought it down to ₹20,500. That’s ₹18,000 saved yearly.

Final Thoughts

All these updates come directly from the RBI’s June 2025 policy. To read full policy jargon is not easy. That is why it is important to break it down,we simplify it in a way that actually connect it to your daily life.

If you have got a loan or you are planning to invest, now is a good time to review your options.

Note: The numbers and information in this article—like interest rate changes, inflation, and GDP growth—are taken from the RBI’s official Monetary Policy Statement (June 2025).

Also read: India’s Financial Inclusion Revolution: 3 Big Reasons 👉 https://cardguidance.com/financial-inclusion-rbi-upi-india/